Purpose

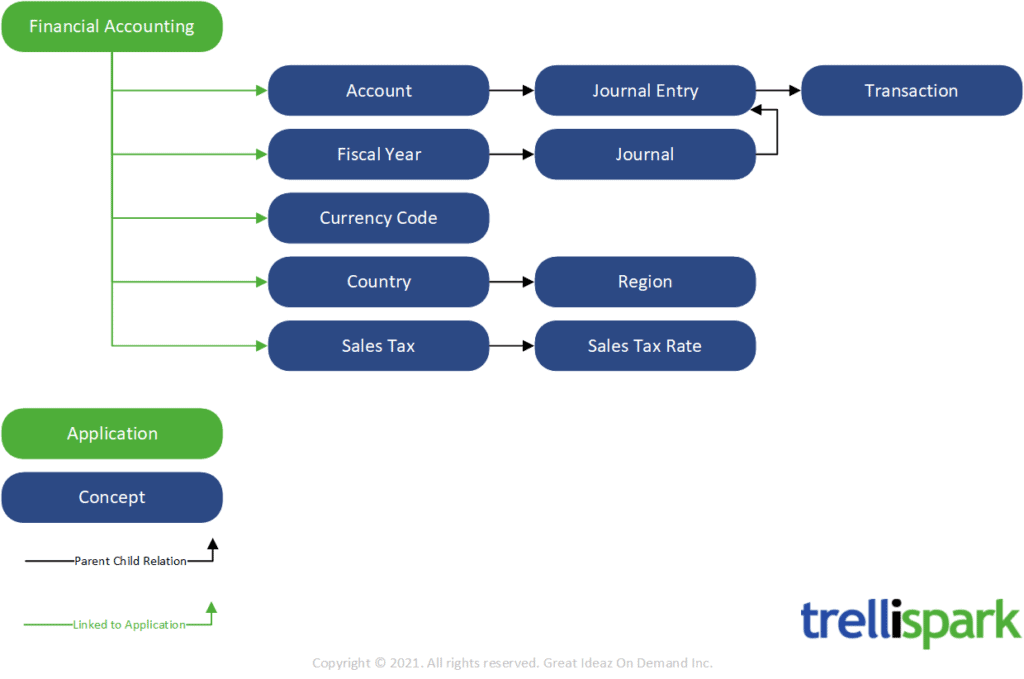

This application helps you to track your finances in your organization using virtual journals and transaction records.

Benefits

- Track how money flows through your organization – Recording your transactions lets you know where your money is coming from and where it is going.

- Enforce financial controls – Apply strict rules to who can create and authorize journal entries to move funds between accounts.

- Improve financial transparency – Funds can only be moved between financial accounts by journal entries, which require an explanation and authorization.

- Easy end-of-year accounting – Financial accounts are adjusted and balanced throughout the year as journal entries are created.

- Record and update sales tax rates – Creating a Sales Tax allows you to automatically apply that tax to specified products and services. Updating the rate in this one location automatically changes the rate that will be applied from the specified date onwards.

- Track your sales regions – Your sales regions can be used by the Customer and Client Management application to compare how the different areas you operate in are performing in terms of sales, customers, and more.

Features

- Create a set of journals for each financial year

- Create multiple entries in each journal

- Record the purpose of each entry

- Move funds between multiple accounts in each entry

- Identify entries that do not balance or are not correctly authorized

- Sort transactions by date or account

- Update sales tax rates to be used automatically by your orders and invoices system